Nursing Home Expenses & Medicaid

March 19, 2010

America has a healthcare crisis. President Obama is now battling with Congress to deal with long term issues involving healthcare.

America has a healthcare crisis. President Obama is now battling with Congress to deal with long term issues involving healthcare.

An area of healthcare that is very often overlooked deals with what happens to Americans when they can’t care for themselves.

The best way to maintain a senior is to keep them in their home under circumstances that they are comfortable with. Seniors live longer when they can stay in their home. If they need help beyond what relatives and friends can provide, home healthcare aides can assist them. As individuals age, sometimes their needs exceed those what can be provided for them in their home.

The needs of seniors are often met by assisted living facilities and nursing homes. Assisted living facilities are generally speaking private pay living arrangements. Seniors who do not have problematic medical needs and have the financial ability to sometimes choose to live in these facilities. The cost of assisted living facilities can be anywhere from $3,000 to $7,000 per month in the metropolitan New York area.

Seniors who have greater medical needs often go to rehabilitation facilities or nursing homes. Nursing homes can cost anywhere from $8,000 to $15,000 per month depending on the level of service the senior needs. How does a middle class person go to a nursing home without all of his assets utilized to pay for his or her care?

There is a program that under certain circumstances pay for long term rehabilitation and/or nursing home stays. This program is called Medicaid. The rules and circumstances involving Medicaid are complex and detailed. The most important rule for the public to understand is that there is a 5 year look back concerning the transfer of assets.

If you have assets and you wish to protect them for future generations, it is important that you see an attorney that handles estate work. Planning can be done to insure that if you do end up in a nursing home, all of your assets including your home, stocks, bonds, pensions, 401(k) and savings won’t be utilized to pay for long term nursing care. You cannot wait until you are very elderly and sick to use this type of estate planning. It must be done a minimum of 5 years prior to the need for nursing home or rehabilitation care.

Should you have questions, contact the Law Office of Elliot S. Schlissel. We can provide you with further information concerning Medicaid and estate planning. Contact us at 1-800-344-6431 or email us at schlissel.law@att.net.

Picture courtesy of levinperconti.

Long Term Care Hospitals – A Capitalist Solution

March 17, 2010

During the past quarter of a century there have been over 400 long term care hospitals built in the United States. These hospitals do not provide acute care for specific illnesses. They are, generally speaking, holding facilities for individuals who are too sick for nursing homes but not sick enough for regular hospitals.

During the past quarter of a century there have been over 400 long term care hospitals built in the United States. These hospitals do not provide acute care for specific illnesses. They are, generally speaking, holding facilities for individuals who are too sick for nursing homes but not sick enough for regular hospitals.

Patients often stay for many weeks or months in these facilities. Many of these patients are senior citizens. Long term care hospitals have a much higher rate of bed sores and infections among their patients than regular hospitals. They are also more profitable than regular hospitals. They generally do not do surgery in the long term care facilities or handle medical emergencies. Patients needing these services are transferred to general hospitals.

A large portion of the bills paid for the treatment at long term care hospitals are paid by Medicare. For profit, long term care hospitals often spend less money on patients and have higher profit margins than regular hospitals.

Inspections in the past 3 years in long term care hospitals have found increasing levels of violations of healthcare standards. Many long term care hospitals do not maintain staff physicians on a 24 hour basis. If you have a friend or loved one in along term care facility, you should monitor their treatment to see to it that they are provided with an appropriate level of medical care.

Should you have any problems regarding a hospital stay or a stay at a long term care facility, feel free to contact the Law Office of Elliot S. Schlissel at 1-800-344-6431 or email us at schlissel.law@att.net.

Picture courtesy of life123.com.

Congress Should Help Homeowners

March 15, 2010

The federal government has bailed Wall Street firms out to the tune of $700,000,000.00. This is a form of corporate welfare. The restructuring was done to prevent large Wall Street firms from going bankrupt. Instead of amending the Bankruptcy Law to help these Wall Street firms, the government simply gave them $700,000,000.00 in loans.

The federal government has bailed Wall Street firms out to the tune of $700,000,000.00. This is a form of corporate welfare. The restructuring was done to prevent large Wall Street firms from going bankrupt. Instead of amending the Bankruptcy Law to help these Wall Street firms, the government simply gave them $700,000,000.00 in loans.

Recently, Jamie Dimon of JP Morgan Chase and Lloyd Blankfein received millions of dollars in salary packages. The government bails out Wall Street and the Wall Street tycoons get richer and richer. During this period of time, between 7.1 million and 7.9 million households according to mortgage bond trader, Amherst Securities, fell behind in their mortgage payments and are subject to losing their home.

It is estimated that as many as 25% of all the homes in the United States have mortgages on them that are greater than the value of their home. The term used to describe this situation is calling the home “under water”. President Obama had initially asked that when individuals do mortgage modifications with their banks that the banks restructure their mortgage so they only have to pay an amount equal to the value of their home. The banks have refused to do this. The mortgage modifications by banks in the United States modify the payments but do not reduce the amount that is owed.

The Bankruptcy Law Needs to Be Changed

The United States Constitution reserves all rights to make laws concerning bankruptcies to the federal government. Congress passes all laws that deal with bankruptcy.

Congress needs to strengthen the bankruptcy court’s ability to restructure mortgage loans when individuals file bankruptcy. Congress has already bailed out Wall Street. Now they need to bail out the American homeowner. Unfortunately, the large financial institutions in this country oppose any modifications to the Bankruptcy Law to help out homeowners.

Congress needs to help the American homeowner and modify the Bankruptcy Laws to deal with the issue of restructuring mortgages that are under water. Congress has already bailed out the financial industry to the tune of $700,000,000.00, now they need to bail out the American homeowner!

Should you have questions concerning bankruptcy or mortgage modifications, feel free to contact the Law Office of Elliot S. Schlissel to discuss these matters at 1-800-344-6431 or email us at schlissel.law@att.net.

Picture courtesy of grassland properties.

Hospitals, Do They Help Us Or Kill Us

March 10, 2010

More than 48,000 people die each year from illnesses and diseases picked up during hospital stays. Approximately 20% of the patients in hospitals who develop sepsis, a blood infection, following surgery die. Patients who develop sepsis stay approximately 1 ½ weeks longer in hospitals than their original planned hospital stay. It is estimated that 1.7 million infections related to health care procedures are diagnosed each year.

More than 48,000 people die each year from illnesses and diseases picked up during hospital stays. Approximately 20% of the patients in hospitals who develop sepsis, a blood infection, following surgery die. Patients who develop sepsis stay approximately 1 ½ weeks longer in hospitals than their original planned hospital stay. It is estimated that 1.7 million infections related to health care procedures are diagnosed each year.

Most hospital stays are for fairly routine procedures. Should the patient develop pneumonia or sepsis as a bi-product of this hospital stay, these infections can be deadly.

Hospitals should make a greater effort to improve hygiene, cleanliness and take other effective measures to prevent unnecessary hospital caused infections.

Should you have a problem related to a hospital stay, feel free to contact the Law Office of Elliot S. Schlissel to discuss this matter at 1-800-344-6431 or email us at schlissel.law@att.net.

May/December Romance Needs a Pre-Nuptial

March 8, 2010

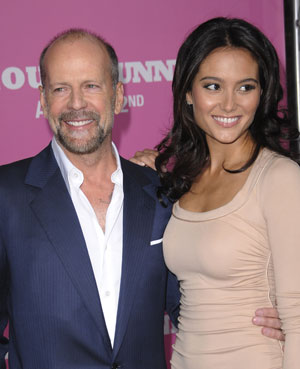

Aging movie stars often have relationships with young beautiful women. There are many examples of these “May/December” relationships. Michael Douglas, age 65, is married to the beautiful Catherine Zetta Jones, age 40. Lorenzo Lamas, age 52 is engaged to be married to Shawna Craig, age 23. Bruce Willis, who was formerly married to Demi Moore, is 54. He recently married, Emma Hearning, a 30 year old model. He trumps his ex-wife, Demi, who is 47 years old and married to the 32 year old, Austin Kutcher.

Aging movie stars often have relationships with young beautiful women. There are many examples of these “May/December” relationships. Michael Douglas, age 65, is married to the beautiful Catherine Zetta Jones, age 40. Lorenzo Lamas, age 52 is engaged to be married to Shawna Craig, age 23. Bruce Willis, who was formerly married to Demi Moore, is 54. He recently married, Emma Hearning, a 30 year old model. He trumps his ex-wife, Demi, who is 47 years old and married to the 32 year old, Austin Kutcher.

How do these aging movie stars avoid losing their shirt when these Hollywood marriages fail. One way, that anyone with assets can avoid losing a substantial portion of their assets in a divorce is to have a Pre-Nuptial Agreement. Pre-Nuptial Agreements basically set up a plan for the division of assets and for spousal support (alimony) should the marriage fail. The agreements are straight forward and deal with all financial marital issues.

Pre-Nuptial Agreements are now commonly used by individuals who are married more than once during their lifetime. They deal with problems presented at the time of divorce, they also deal with inheritance rights in the event one of the parties to the marriage (usually the older man) dies first.

I have written many Pre-Nuptial Agreements in my legal practice that deal with May/December marriages. I often wonder about the basis of these relationships. Is it the financial security the deep pocketed man provides or is it true love? I am sure love is a factor but I very rarely come across a May/December marriage where the man is both older and poor!

Should you have a question about a Pre-Nuptial or Post-Nuptial Agreement, feel free to give the Law Office of Elliot S. Schlissel a call at 1-800-344-6431 or email us at schlissel.law@att.net.

Picture of Bruce Willis & Emma Hearning courtesy of iVenus.com.

Who Needs a Will? You Do!

March 5, 2010

Do you have assets? Do you own a house? Have you been married more than once? Do you have children from more than one relationship? Are you concerned about what happens after your death to your spouse and/or your children? Are you single? All of the above individuals need a Will.

Do you have assets? Do you own a house? Have you been married more than once? Do you have children from more than one relationship? Are you concerned about what happens after your death to your spouse and/or your children? Are you single? All of the above individuals need a Will.

Estate contests often develop between children from the first marriage and the second wife. Issues arise when a man or a woman has children from more than one relationship. Sometimes loved ones have financial difficulty and the possibility of receiving assets in an estate brings out the worst in them.

There is a simple way to avoid unnecessary expensive litigation that can last from months or years. Write a Will! A Will states who your loved ones are, what your assets are and who will receive your assets at the time of your death. No one looks forward to dying. The thought of writing a Will is often an issue that individuals seek to put off. However, a Will should be written when you are competent and healthy not right before your death.

Attorneys that handle Wills & Estates prepare Wills. They are generally speaking inexpensive documents to have prepared. They simplify your end of life issues and allow your assets to pass in an orderly manner. Wills cut down on financial disagreements developing among your heirs and loved ones.

If you die without a Will your assets pass to your loved ones through administration proceedings. These proceedings can be time consuming and tedious. More than one person can request to be the Administrator of your estate. This can lead to arguments, bad feelings and increased attorney’s fees.

If you have assets or loved ones, you need a Will! Have it written by an attorney before you are too sick and old to deal with it.

Should you have questions regarding drafting a Will, feel free to call the Law Office of Elliot S. Schlissel to discuss these issues at 1-800-344-6431 or email us at schlissel.law@att.net.

Established in 1978,

Established in 1978,